Tax data and top incomes

Tax data are an important source of information for a wide range of statistical series. Their use, however, has been mainly confined to the analysis of the impact of fiscal policies on different socio-economic groups. Nevertheless, a recent group of researchers has started using personal income tax data to construct top income shares series, i.e. series of the share of highest income individuals or households in national income, and to analyse their evolution over the long run in several countries.

The only precedent of using those data for calculating income shares is the work of Simon Kuznets1, who in the 1950s constructed series of the shares of upper income groups in the U.S. economy’s income and savings. Since 2001, however, new statistical series have been released for more than twenty countries all over the world, including developed and developing economies in North America (U.S. and Canada); South America (Argentina); Asia (China, India, Indonesia, Japan and Singapore); Central and Western Europe (France, Germany, Netherlands and Switzerland); Northern Europe (Finland, Ireland, Norway, Sweden and United Kingdom); Southern Europe (Italy, Portugal and Spain); and Oceania (Australia and New Zealand).

A compilation of these studies can be found in Atkinson and Piketty 23. In addition, the series are available at the World Top Incomes Database. In comparison to pre-existing databases, based on household income surveys conducted during the last three or four decades, this database based on tax data covers a longer period of time, which for some countries up to more than 100 years. Data availability makes possible long-run analyses, which are the only able to identify structural changes in income distribution patterns. Moreover, tax data also allow to analyse separately the evolution of labour and capital incomes of different individuals or families.

As the authors who review the main findings of countries’ data analyses4 admit, top income data compilations using tax sources have several shortcomings. They are restricted to top income families’; they considered the amount of gross incomes before taxes; and, it is worth to bear in mind, that the definition of income and fiscal subjects are not the same in each country and vary over time. Furthermore, only taxpaying population is covered by the data series, and both tax evasion and avoidance can underestimate income magnitude, as well as the share of top income earners in national income distribution.

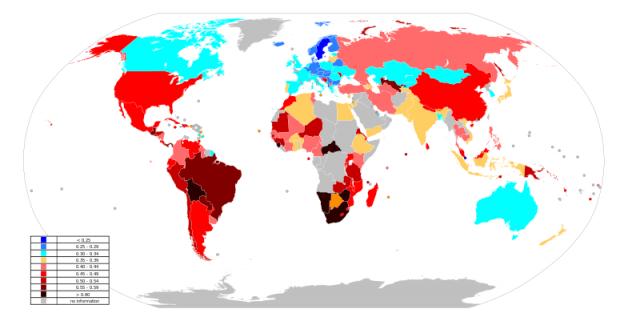

All these factors make tax data compilations not adequate for typical inequality analyses on Gini index evolution, State redistributive policies, or cross-country comparisons. However, some authors have found a significant relationship between top income shares and inequality measures, like the Gini index5. Moreover, data on after-tax incomes can be also obtained; and series can be corrected and homogenized. In addition, in the view of Atkinson, Piketty and Saez (2011: 40), “legally tax-exempt capital income poses more serious problems than tax evasion and tax avoidance per se”. Finally, household surveys’ data, the other sources for personal income series, present their own problems as a consequence, among other factors, of lack of and incomplete responses to surveys, and also income underreporting.

Top incomes studies main finding is a U-shaped pattern in the evolution of the shares of highest earners in households’ available income. Those shares dropped during the first half of the Twentieth Century, especially around World Wars and the Great Depression; but increased during the second, particularly in recent decades. Overall gains have been concentrated within the top percentiles of most countries under study.

In Western English speaking countries, China and India the increases have been substantial. According to World Top Income Database data, in the U.S. the share of the top decile reached almost 50 percent, meanwhile the top percentile of income earners hoarded more than 23 percent of available income in 2007, capturing two-thirds of income growth since the beginning of the century. Top income shares increases in Southern European and Nordic countries have been smaller, but still relevant. In Spain, the share of the 1% richest households in available income rose from 7.6% in 1981 to 12.6% in 2006, when capital gains up to 42.5% of those households’ income, presumably as an outcome of the housing bubble. Just only in Continental European countries and Japan top income shares gains have been very modest.

Atkinson, Piketty and Saez have also found been major changes in the composition of top incomes, according to income sources. Capital gains are excluded from their analysis due to the lack of data for a majority of countries. Without taking them into account, the shares of capital incomes in richest families or individuals income show that they were the main source of income for those families during the first half of the century, especially for highest earners. Meanwhile, top income shares gains during the second have been due to the increase in top labour incomes (top executives remuneration), which have risen its share in the composition of the very top incomes, as it is, for example, the case of Canada.

The authors review several possible explanations for the growth of top incomes: typical Kuznets curve explanation based on the relevance of sectoral structural change; or the effect of skill-biased technical change in wage dispersion. The explanatory power of these factors is not enough to account for the overall increase in top income shares. Thus, the authors also consider other explanatory factors suggested by several theoretical models, ranging from politics and political economy to financial crises, global forces or progressive taxation. However, a lack of systematic explanation of the evolution of top income shares stands.

It is true that this kind of explanation must include multiple factors, but other authors have found that a general relationship between distributional variables at macroeconomic and individual level can be stated. Specifically, the share of any income quantile in available income is linked to the evolution of factor, capital and labour, shares in national income by personal income composition according to its sources. Empirical evidence suggest that when profits share in national income increases it also does top incomes share in personal or household distribution 6 7.

Atkinson, Piketty and Saez take into account this factor when quoting the study of Sweden, which authors found high correlation between capital share and top percentile income share evolutions 8. As long as top income shares are pre-tax calculations, the evolution of functional distribution seems to be a more appropriate explanatory factor than progressive taxation, one of the central factors considered in top incomes studies. Nevertheless, Atkinson, Piketty and Saez do not develop the potential explanatory power of aggregate distribution of income between profits and wages for establish a general theory of the evolution of top incomes.

In any event, the research field opened by the authors who have compiled top incomes tax data is very important and further research will be able to deepen the explanations given. Not only that, but top incomes data releasing has been also a major factor explaining the eruption of “The 1 percent vs. the 99 percent” social movement, which denounce the dramatic rise of top incomes shares in several countries.

References

- Kuznets, Simon (1950): Shares of Upper Income Groups in Income and Savings. UMI ↩

- Atkinson, A. B. and Piketty, Thomas (eds.) (2007): Top Incomes over the Twentieth Century: A Contrast between Continental European and English‐Speaking Countries. Oxford University Press. Oxford. ↩

- Atkinson, A.B. and Piketty, T. (eds.) (2010): Top Incomes: A Global Perspective. Oxford University Press. Oxford. ↩

- Atkinson A.B.; Piketty T.; and Saez E. (2011): “Top Incomes in the Long Run of History”, Journal of Economic Literature, 49. pp. 3-71 ↩

- Leigh, A. (2007): “How Closely Do Top Income Shares Track Other Measures of Inequality?”, The Economic Journal, 117. pp. 619-633. ↩

- Daudey, E. and García-Peñalosa, C. (2007): “The Personal and the Factor Distributions of Incomes in a Cross-Section of Countries”, Journal of Development Studies, 43 (5). pp. 812-829. ↩

- Adler, M. and Schmid, K.D. (2012): “Factor Shares and Income Inequality. Empirical Evidence from Germany, 2002-2008”, IAW Discussion Papers, 82. ↩

- Roine, J. and Waldenström, D. (2008): “The Evolution of Top Incomes in an Egalitarian Society: Sweden, 1903–2004”, Journal of Public Economics, 92 (1–2). pp. 366–87. ↩

1 comment

[…] Publicado originalmente en inglés en Mapping Ignorance. […]