The role of Government in financing health care (1)

The role of Government in financing health care (1)

Insurance markets are far from meeting the conditions that make competitive markets efficient. Here is an incomplete but illustrative list of problems in the case of health insurance:

- Externalities: my health quality affects me, but also affects people around me, like in the case of contagious diseases. Economic theory predicts that consumers will not purchase an optimal amount of health insurance for this reason.

- Public good: the level of inequality is a characteristic of the society. Individuals may or may not care about it, but if they do, this level is a public good that cannot be optimally reduced by individual, voluntary acts. Universal health care is a way to mitigate inequalities via guaranteeing a minimum equality of opportunities.

- Time inconsistency: the Government cannot commit not to take care of a person who voluntarily decided not to purchase a health insurance policy.

- Asymmetric information: sometimes consumers know better their risk group than the insurer, some other times it is the other way around, and health care providers know much better the quality of the service than the consumer. These asymmetries in the information create problems in the way insurance firms can pool risks.

Given all these, what is a reasonable way to structure the health system? Which is a balanced policy that takes into account the benefits of competition and of consumers’ responsibility, and the goals to minimize the problems mentioned above?

Stabile and Thomson (2014) 1 offer an international perspective on the way the role of the State has changed in a group of developed countries, and on the effects of those changes, as reflected in the documented works that have studied the changes. Their summary does not provide an answer on how to optimally design a health care sector, or how to deal with all of the problems, but offers some insight into which particular elements of a health care sector favor quality, help to improve risk pooling and are able to control the costs. In this article we will review the findings on financing and risk pooling. A second part of the article will deal with other aspects like demand of services, evaluation and coverage decisions.

1. Financing

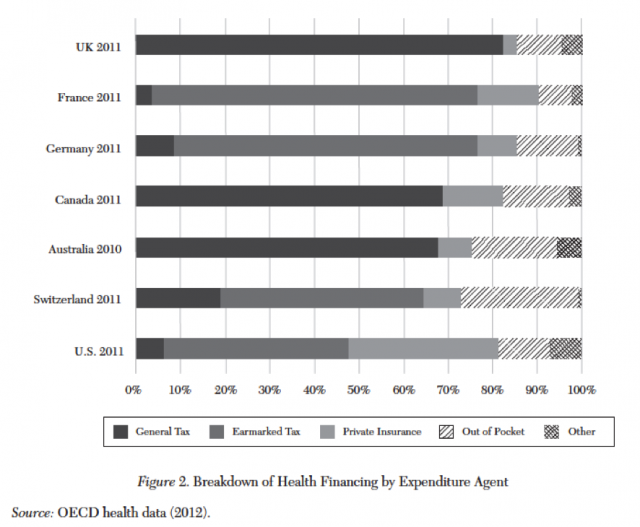

There are two main ways to finance a public health system: social insurance contributions and taxes. They are equivalent when the contributions are applied to an entire population, and with the conditions that no one can opt out and that the benefit is not linked to the contribution. Otherwise, they will have different effects on distorting individuals’ economic decisions, as the literature on optimal taxation shows. When different, the two systems also have different effects on redistribution, with the contributions being more regressive.

In one recent study, Wagstaff (2010) 2 uses system changes from general tax financing to social insurance within OECD countries between 1960 and 2006 and finds indications of an increase in health care costs of 3 to 4 percent, and of a decline of 8 to 10 percent in employment, associated with a move to social insurance. Also, no declines in avoidable mortality are found in the transition to social insurance. Another paper (Wagstaff and Moreno-Serra 2009, 3), examining transitions in Eastern European and Asian countries between 1990 and 2003, finds higher impacts, with costs increases on the order of 11%, with a 3% increase hospitalizations (although the average stay declined), and again with no evidence of differences in health outcomes.

Cylus, Mladovsky, and McKee (2012) 4 find that countries that finance their health systems through taxes are more able to control expenditure in times of economic crises. A similar result is found in a macroeconomic simulation reported by Baicker and Skinner (2011) 5. The observed tendency is of a move towards a diversification of financing methods, adding taxes to social security contributions.

Cost sharing and user fees constitute a third way of financing. However, they are proven to be very inefficient. For instance, Schokkaert and Van de Voorde (2011) 6 note that user fees may be optimal only under unrealistic assumptions. Note that this is a study only on fees as a collecting mechanism. I.e., given an amount of money to be collected, the study shows the distortion generated by users’ fees compared to taxes or social insurance contributions. Nothing is said about whether fees are suited to discourage the over use of health services.

2. Pooling risk

The essence of the insurance business is to pool individual risks. In this case, the risk of a loss related to health. One question to address is how to make the pooling. According to the standard models for insurance markets, if everyone faces the same risk, then everyone would pay a price for an insurance that reflects the expected cost of the loss. If different individuals face different risks, then many questions arise. For instance, if individuals know their risk group, low-risk individuals would demand policies that pool them with other low-risk individuals and pay a smaller price. If they get their way, high-risk individuals will face a high price and, if their income is low, they may not be able to buy a proper policy. On the other hand, if high and low-risks are pooled together, then it is the low-risks that find the price too expensive (compared to their risk) and may opt out and not pay the insurance.

The problems can mount. If the risk may be known to the insurance company, but not to the individual, should the company be allowed to obtain and use this information? There are also problems when insurance firms may engage in opportunistic behavior in the way they cover the expenses or in the way the try to get rid of the high risk customers if they cannot be charged the expenses. This collection of problems calls for some form of public intervention. The simplest one is to pool all of the individuals in a public health service and make public insurance mandatory and financed through taxes, social insurance contributions. However, this intervention may have undesired side effects, like the absence of competition. This has made some countries adopt other methods, with a health sector with different pools (some public, some private) and some possibilities of consumers’ choice. It is usually a political objective to avoid risk selections, which would imply that all pools (all insurance companies) include both high and low risk individuals in the same proportion.

One way of dealing with the problem is by providing subsidies to individuals to enable them to buy high cost insurance. Van de Ven and Schut (2011) 7 note that premium subsidies are unlikely to be optimal: as they do not specifically target the high risk individuals, they do not create the incentive for efficient purchasing of insurance by high-risk individuals; and encourage excess purchase of insurance for the rest (Zweifel and Manning 2000 8). In contrast, subsidies based on observable risk factors such as age, sex, and health status, retain consumer price sensitivity and can be adjusted over time to reflect changes in consumer risk (van de Ven 2006 9). A more common way of risk adjustment is to subsidize the insurer directly, where similar problems are encountered.

Overall, the paper finds that countries with competitive health insurance and multiple risk pools have all improved their risk equalization mechanisms in the past decade. However the problem persists and in some places like Switzerland, it is especially important.

References

- Stabile M. (2014). The Changing Role of Government in Financing Health Care: An International Perspective , Journal of Economic Literature, 52 (2) 480-518. DOI: http://dx.doi.org/10.1257/jel.52.2.480 ↩

- Wagstaff, A. 2010. “Social Health Insurance Reexamined.” Health Economics 19(5), 503–17. ↩

- Wagstaff, A., and Moreno-Serra, R. 2009. Europe and Central Asia’s Great Post-communist Social Health Insurance Experiment: Aggregate Impacts on Health Sector Outcomes. Journal of Health Economics 28(2), 322–40. ↩

- Cylus, J.; Mladovsky, P., and McKee, M. 2012. Is There a Statistical Relationship between Economic Crises and Changes in Government Health Expenditure Growth? An Analysis of Twenty-Four European Countries. Health Services Research 47(6), 2204–24 ↩

- Baicker, K., and S. Skinner, J. 2011. Health Care Spending Growth and the Future of U.S. Tax Rates. National Bureau of Economic Research Working Paper 16772. ↩

- Schokkaert, E., and Van de Voorde, C. 2011. User Charges. In The Oxford Handbook of Health Economics, edited by Sherry Glied and Peter C. Smith, 329–53. Oxford and New York: Oxford University Press. ↩

- van de Ven, W.P.M.M., and Schut, F.T. 2011. Guaranteed Access to Affordable Coverage in Individual Health Insurance Markets. In The Oxford Handbook of Health Economics, edited by Sherry Glied and Peter C. Smith, 380-404. Oxford and New York: Oxford University Press. ↩

- Zweifel, P., and Manning W.G. 2000. Moral Hazard and Consumer Incentives in Health Care. In Handbook of Health Economics, Volume 1A, edited by Anthony J. Culyer and Joseph P. Newhouse, 409–59. Amsterdam and New York: Elsevier. ↩

- van de Ven, W.P.M.M. 2006. Response: The Case for Risk-Based Subsidies in Public Health Insurance. Health Economics 1(2), 195–99. ↩

3 comments

[…] View the original here: The role of Government in financing health care (1) | Economics … […]

[…] aldatzen ari da estatuaren papera herrialde garatuetan? José Luis Ferreirak ditu erantzuna batzuk The role of Government in financing health care (1) […]

[…] Los mercados de seguros están muy lejos de ser eficientes. ¿Cómo debería estructurarse entonces el sistema de cuidado de la salud?¿Y qué papel debería desempeñar el estado?¿Cómo está cambiando este papel en los países desarrollados? José Luis Ferreira tiene […]