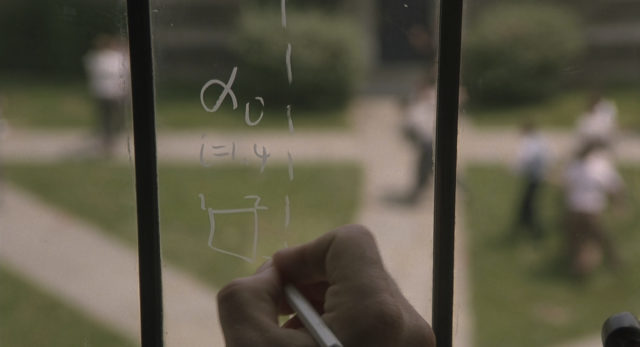

The properties that characterize the definition of Nash equilibrium

The properties that characterize the definition of Nash equilibrium

Strategic decision is the object of study for Game Theory, a discipline that started officially with the book The Theory of Games and Economic Behavior, by John von Neumann and Oskar Morgenstern 1. For non-cooperative games, i.e., games in which individuals make decisions individually and with no strings attached, the book was restricted to zero-sum games. These are games, like poker, in which the gains of one individual is the loss of another. The authors proved the maximin theorem that, essentially, said the following: if players use their maximin strategy, the result is a situation from which no one wants to depart unilaterally. Also, the maximin strategy comes after a prudent behavior: first a player observes the worst scenario after each of his or her strategies and, then, chooses the strategy in which this worst scenario is the least bad.

Not all games are like that. In fact, most are not, including almost all economic, social and political applications of the theory. For the generality of games, where both cooperation and conflict coexist, John Nash proposed his definition of equilibrium 2. Basically, it concentrated on the part of no-unilateral deviations and discarded the behavioral aspect. As a result, he was able to analyze almost any game, but at the cost of not providing a behavioral theory of why players played that way. I.e., there is an explanation of why if players reach an equilibrium the do not depart from it, but there is no explanation of why the reach the equilibrium in the first place. For many games, the literature has indeed found some compelling behaviors or dynamics that justify why and how the equilibrium may be reached (rationalizable strategies, elimination of dominated strategies, evolutionary stability, best reply dynamics, etc.). Even if there is not a general answer to the question of which behavior leads to a Nash equilibrium, all these particular cases help us in understanding when it is a reasonable expectation in a given game.

In addition to the above, there are other attempts at understanding the value of the Nash equilibrium by providing an axiomatic characterization of it. In plain English, a characterization is just a list of properties that are satisfied as a whole by the definition of Nash equilibrium and only by it. This way, by looking at the likelihood that these properties are sensible in a given game, one will also have an idea of the likelihood of the equilibrium as an appropriate solution as well. So far, there have been discussions about what games should be considered strategically equivalent or isomorphic and which should be desirable properties to be satisfied by a solution of the game. For instance, rationality implies that the solution of a game in a normative sense must be a Nash equilibrium, but it does not rule out that it may be a subset of them 3. On the other hand, rationality does imply that the solution is a correlated equilibrium 4, a concept close but not equal to Nash equilibrium. However, no exact axiomatic characterization was available for Nash equilibrium. The recent work by Mark Voorneveld 5 offers an answer to this question. As summarized in the abstract, the characterization is as follows:

For strategic games, the Nash equilibrium concept is axiomatized using three properties: (i) if the difference between two games is ‘strategically irrelevant’, then their solutions are the same; (ii) if a player has a strategy with a constant payoff, this player need not settle for less in any solution of the game; (iii) if all players agree that a certain strategy profile is optimal, then this strategy profile is a solution of the game.

As it is usually the case with axiomatic characterization, it starts with a definition of classes of equivalence within the set of games, and then with the requirement that the solution is consistent with this equivalence. What is considered equivalent in property (i) is the following. Consider a given game, if one fixes the strategies played by all players except you, then your payoffs depend only on your strategy choice. It will be something like this: if you choose your first strategy you get X, if you choose your second strategy you get Y, and so on. Now suppose that you replace those payoffs (X, Y,…) with payoffs (X+a, Y+a,…) then these two games would be strategically equivalent as the difference in payoffs is irrelevant.

Property (ii) is a consistency check. It requires a minimum condition to be satisfied in certain games in which a player has a strategy that gives the same constant payoff regardless what other players do. In these games, the solution cannot give this player a smaller payoff than this constant (otherwise, this player would be making a non-optimal move).

Finally, property (iii) is a unanimity rule that says that if there is a strategy profile (a selection of one strategy for each player) so that the outcome each player gets is the highest payoff he can get in the game, then this strategy profile must be part of the solution.

Proving that the concept of Nash equilibrium satisfies properties (i), (ii) and (iii) is easy. If the Nash equilibrium did not satisfy either of them, that would imply that at least a player has a profitable deviation, in contradiction with the definition of Nash equilibrium. For instance, if property (ii) is not satisfied and a solution leads to Player i getting a payoff smaller than his sure value, he would deviate to the strategy giving that value and increase his payoff.

A more demanding task is showing that any solution satisfying all three properties must be a Nash equilibrium. The proof first considers games in with property (iii) defines the solution and then extends the solution to games within the same class of equivalence according to property (i). After that, one shows that all solutions satisfying the last property must be the same. Since the Nash equilibrium satisfies the property, any solution coincides with the Nash equilibrium.

The last thing to show is that the three properties or axioms are logically independent. This is done by finding solutions that satisfy two of them, but not the third. For instance, the trivial solution that chooses all strategies as the solution of the game satisfies (i) and (iii), as it selects the same strategies in all equivalent games (it selects everything) and it also selects the optimal strategy in games where it exists (it selects many more things, of course, but it also selects the best), but does not satisfy (ii). In games where a player has a strategy that gives a constant payoff, it also selects as a solution any other strategy even if it gives a payoff worse than that.

References

- Von Neumann, J., and Morgenstern, O. 1944. The Theory of Games and Economic Behavior. Princeton: Princeton University Press. ↩

- Nash, J. 1950. Equilibrium points in n-person games. Proceedings of the National Academy of Sciences 36:1, 48-49. ↩

- Myerson, R.B. 1997. Game Theory. Analysis of Conflict. Harvard University Press. Cambridge. ↩

- Aumann, R.J. 1987. Correlated Equilibrium as an Expression of Bayesian Rationality. Econometrica 55:1, 1-18 ↩

- Voorneveld, M. 2019. An axiomatization of the Nash equilibrium concept. Games and Economic Behavior 117, 316–321 doi: 10.1016/j.geb.2019.07.011 ↩

1 comment

Analyze conditions necesaary for conourt-nash equilibrium under oligopoly arrangements.